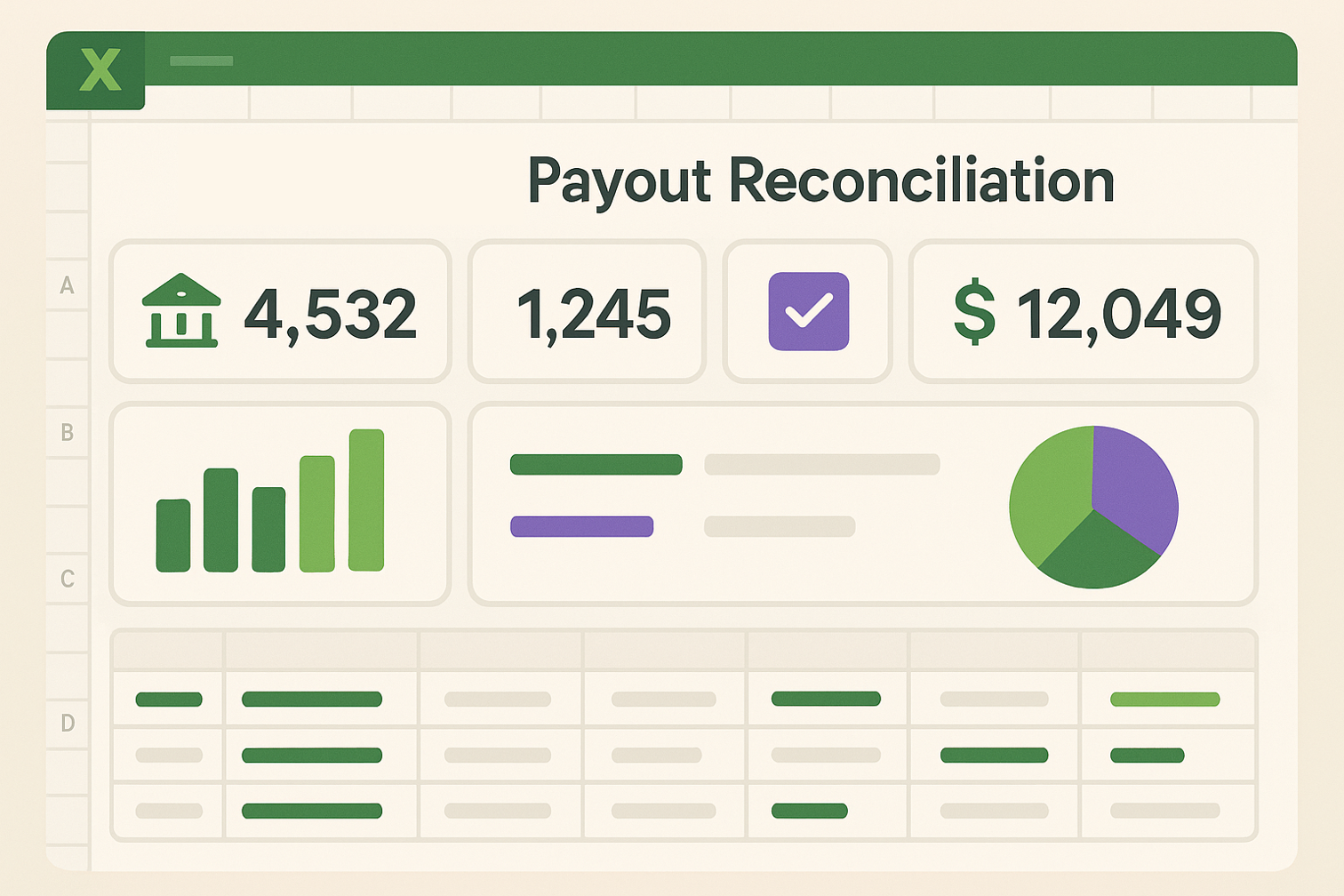

Payout Reconciliation that shows where your money went

Profit AnalysisMatch payouts to orders in minutes. See fee overcharges. Download a clean Excel for your accountant.

Your first run is free - no card required.

Match payouts to orders in minutes. See fee overcharges. Download a clean Excel for your accountant.

Your first run is free - no card required.

📍 Reconciliation engine complete, gateway-specific fee mapping in progress

Get a ready-to-use file with everything you need

Payout vs bank deposits, shortage/excess

Orders that never reached the bank + reason

Contracted vs charged, overcharge flags

Batch→transaction drilldown, CSV export

Platform-specific implementations of this decision kit with unique insights for each

Real outcomes for your business

Recover missed cash: Find payout mismatches & hidden fees-often meaningful dollars back each month

Save your weekend: 4-8 hours back each month from manual reconciliation

Be audit-ready: Line-by-line trail you can share with your accountant

Reduce audit risk: Complete transaction-to-payout audit trails and mismatch documentation

You want to prevent money from slipping through the cracks

You've seen payout totals not match your bank deposits

You want a ready Excel (not a new dashboard) you can trust

From order totals to actual deposits, tracking every dollar

Definition: Transactions where expected payout ≠ actual deposit

Source: Order data vs. gateway payout reports

Granularity: Per-transaction, grouped by payout batch

Definition: Sum of all mismatched amounts + unexplained fee differences

Source: Expected fees vs. actual fees charged

Granularity: Per-payout period (weekly/monthly)

Definition: (Actual fees - Expected fees) ÷ Total revenue × 100

Source: Gateway fee schedules vs. actual charges

Granularity: By gateway, by transaction type

Unlock powerful insights with these automated features.

Match every order to its payout batch and identify transactions that never reached your bank account.

Compare contracted rates to actual fees charged, exposing overcharges and unexpected fee categories.

Categorize discrepancies by type (refunds, chargebacks, currency conversion, gateway errors) with actionable reasons.

Complete line-by-line audit trail ready for accountant review, with supporting documentation links.

Hours spent downloading CSVs, cleaning data, and formatting spreadsheets. Every week, every month, every platform.

3 simple steps to your first report

OAuth2 - no passwords

Select your date range

Ready in ~30 seconds

No. Your first report is completely free with no credit card required.

Yes. We use read-only OAuth scopes, and you can disconnect in one click from your dashboard anytime.

We support Shopify Payments and Stripe. WooCommerce Payments is on our waitlist - email us to get notified when it's ready.

You can reconcile the last 3-12 months of payout history. Pick your date range when generating the report.

We access your data with minimal read-only permissions to generate the report. You can disconnect anytime from your dashboard.

No - we give you the numbers so you can contact them yourself and get it resolved fast.

Start automating your e-commerce reporting today and save hours every week.

Our report recipes are designed by e-commerce experts who understand what metrics matter most for your business decisions.

Connect your platforms in minutes, not hours. Our OAuth2 integration makes setup secure and simple.

Reports are delivered in perfectly formatted Excel files that work seamlessly with your existing workflow.

Our report recipes are designed to provide actionable insights and recommendations for your business.

Start using Payout Check (Reconciliation) today and turn your data into decisions

No card • Keep the file forever • Cancel anytime