Why Multi-Channel Sellers Get Margin Math Wrong

You see this in your dashboards:

- Amazon: $50,000 revenue, 200 orders

- Shopify: $30,000 revenue, 150 orders

- eBay: $15,000 revenue, 75 orders

You think: "Amazon is my winner! 53% of revenue!"

The reality after fees:

- Amazon: $50K revenue → $21K fees → $29K net (58% margin)

- Shopify: $30K revenue → $3K fees → $27K net (90% margin)

- eBay: $15K revenue → $3.5K fees → $11.5K net (77% margin)

Before COGS and fulfillment:

- Shopify kept you the most actual dollars ($27K vs $29K vs $11.5K)

- Shopify has the best margin (90% vs 58% vs 77%)

The decision: Should you allocate more inventory to Amazon (highest volume) or Shopify (highest margin)?

This guide teaches you to calculate true channel profitability so you make the right call.

The Complete Channel Fee Breakdown

Shopify Fees (Shopify Payments)

Plan Tier Matters:

- Basic: 2.9% + $0.30 per transaction

- Shopify: 2.7% + $0.30 per transaction

- Advanced: 2.5% + $0.30 per transaction

- Plus: Negotiated (typically 2.15% + $0.30)

Monthly Subscription:

- Basic: $39/month

- Shopify: $105/month

- Advanced: $399/month

- Plus: $2,000+/month

Third-Party Payment Gateways (if not using Shopify Payments):

- Additional 2% fee on top of gateway fees

- Stripe: 2.9% + $0.30 (so 4.9% + $0.30 total on Basic plan)

- PayPal: 3.49% + $0.49 (so 5.49% + $0.49 total on Basic plan)

No Fulfillment Fees - you handle shipping, or pay your 3PL separately

Example $100 Order on Shopify Basic:

- Revenue: $100.00

- Payment processing: $2.90 + $0.30 = $3.20

- Monthly fee allocation: ~$0.20 (assuming 200 orders/month)

- Total fees: $3.40 (3.4%)

- Net to seller: $96.60

Amazon FBA Fees (The Hidden Cost)

Referral Fee (Amazon's Cut):

- Most categories: 15% of item price + shipping

- Electronics, cameras: 8%

- Apparel, jewelry: 17%

- Grocery, health: 8-15% depending on price

FBA Fulfillment Fee (Varies by Size/Weight):

Small Standard (< 16 oz):

- $3.22 to $3.51 depending on dimensions

Large Standard (16 oz - 20 lbs):

- 1 lb: $4.75

- 2 lbs: $5.67

- 3 lbs: $6.24

- Increases ~$0.40 per pound

Storage Fees (Monthly):

- Standard size: $0.87/cubic foot (Jan-Sep)

- Standard size: $2.40/cubic foot (Oct-Dec)

- Oversize: Higher rates

Long-Term Storage (> 365 days):

- $6.90/cubic foot or $0.15/unit (whichever is greater)

Example $100 Order on Amazon FBA (Standard 1 lb item):

- Revenue: $100.00

- Referral fee (15%): $15.00

- FBA fulfillment: $4.75

- Storage (allocated): ~$0.50

- Total fees: $20.25 (20.25%)

- Net to seller: $79.75

BUT WAIT - Customer Returns:

- Amazon charges FBA fee again on returns (even if customer fault)

- 10% return rate? Add another $0.48 per order

- Adjusted net: $79.27

eBay Fees

Final Value Fee:

- Standard: 13.25% of total sale (item + shipping)

- Plus membership: 9.15% for first $7,500/month

Payment Processing (Managed Payments):

- 2.35% + $0.30 per transaction

Insertion Fees:

- 250 free listings/month

- $0.35 per listing after that (one-time)

Optional Upgrades (Promoted Listings, etc.):

- 2-20% additional (optional)

Example $100 Order on eBay:

- Revenue: $100.00

- Final value fee (13.25%): $13.25

- Payment processing: $2.35 + $0.30 = $2.65

- Total fees: $15.90 (15.9%)

- Net to seller: $84.10

WooCommerce (Self-Hosted)

Platform Fees: $0 (you own the code)

Payment Processing (Depends on Gateway):

- Stripe: 2.9% + $0.30

- PayPal: 3.49% + $0.49

- Square: 2.9% + $0.30

- Authorize.net: 2.9% + $0.30 + $25/month

Hosting: $20-300/month depending on traffic

Plugins/Extensions: $0-500/year

Example $100 Order on WooCommerce (Stripe):

- Revenue: $100.00

- Payment processing: $2.90 + $0.30 = $3.20

- Hosting allocation: ~$0.30 (assuming 200 orders/month, $60 hosting)

- Total fees: $3.50 (3.5%)

- Net to seller: $96.50

Similar to Shopify, but you handle all tech/security yourself.

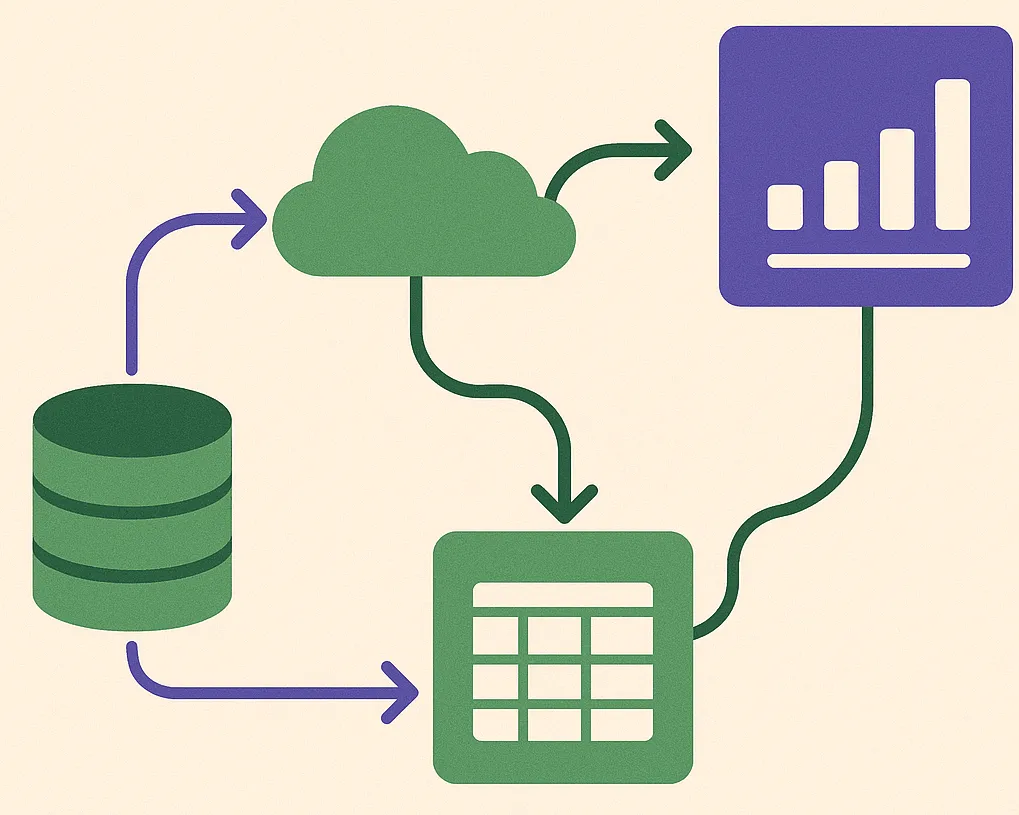

Build a Multi-Channel Profitability Calculator in Excel

-

7

Export Order Data from Each Channel

Shopify: Orders → Export. Amazon: Reports → Order Reports. eBay: Orders → Download. Export last 90 days minimum. Save each as separate CSV.

-

7

Add Fee Calculation Columns

Add columns for: Platform Fee, Payment Fee, Fulfillment Fee, Storage Fee (if Amazon), Total Fees. Use IF statements to apply correct fee structure per channel.

-

7

Calculate Platform Fees by Channel

Platform Fee formula: =IF(Channel='Shopify', 0, IF(Channel='Amazon', Revenue×0.15, IF(Channel='eBay', Revenue×0.1325, 0)))

-

7

Calculate Payment Fees by Channel

Payment Fee formula: =IF(Channel='Shopify', Revenue×0.029+0.30, IF(Channel='Amazon', 0, IF(Channel='eBay', Revenue×0.0235+0.30, Revenue×0.029+0.30)))

-

7

Add Fulfillment Costs

For Amazon FBA: use VLOOKUP to map SKU to weight/size tier, then to FBA fee schedule. For Shopify/eBay: add your actual shipping cost paid.

-

7

Calculate Net Profit per Order

Net Profit = Revenue - COGS - Platform Fee - Payment Fee - Fulfillment Fee - Storage Fee (if any). This is your true profit per channel.

-

7

Create Pivot Table Summary by Channel

Pivot: Rows=Channel, Values=SUM(Revenue), SUM(Fees), SUM(Profit), COUNT(Orders), AVG(Margin%). Sort by profit descending to see most profitable channel.

-

7

Add Visual Dashboard with Charts

Create bar chart comparing Revenue vs Profit by channel. Add pie chart showing % of total profit by channel. Conditional format margin % (red <20%, green >40%).

Real Example: Same Product on 3 Channels

Product: Yoga Mat (Standard size, 3 lbs)

COGS: $12.00

Retail Price: $49.99

On Shopify (Basic Plan, Shopify Payments)

```

Revenue: $49.99

Payment fee: $1.45 + $0.30 = $1.75

Platform fee: $0 (included in subscription)

Fulfillment: $7.50 (your shipping cost)

Total fees: $9.25

Gross profit: $49.99 - $12.00 = $37.99

Net profit: $37.99 - $9.25 = $28.74

Margin: 57.5%

Profit per unit: $28.74

```

On Amazon FBA

```

Revenue: $49.99

Referral fee: $7.50 (15%)

FBA fulfillment: $5.67 (3 lb, standard)

Storage: $0.50 (allocated monthly)

Total fees: $13.67

Gross profit: $49.99 - $12.00 = $37.99

Net profit: $37.99 - $13.67 = $24.32

Margin: 48.7%

Profit per unit: $24.32

```

On eBay (Sold Auction + Managed Payments)

```

Revenue: $49.99

Final value fee: $6.62 (13.25%)

Payment fee: $1.17 + $0.30 = $1.47

Fulfillment: $7.50 (your shipping cost)

Total fees: $15.59

Gross profit: $49.99 - $12.00 = $37.99

Net profit: $37.99 - $15.59 = $22.40

Margin: 44.8%

Profit per unit: $22.40

```

Channel Comparison Summary

| Channel | Net Profit | Margin % | Winner? |

|---------|------------|----------|---------|

| Shopify | $28.74 | 57.5% | ✓ Best |

| Amazon | $24.32 | 48.7% | Mid |

| eBay | $22.40 | 44.8% | Lowest |

But wait - this ignores velocity:

- Shopify: 10 units/month = $287.40 monthly profit

- Amazon: 50 units/month = $1,216.00 monthly profit

- eBay: 5 units/month = $112.00 monthly profit

Amazon wins on total dollars despite lower per-unit margin. Volume matters.

Advanced Multi-Channel Analysis: Where to Allocate Inventory

The Core Question:

You have 100 units of inventory. How do you split across channels to maximize profit?

Method 1: Profit per Unit (Simple)

Just sell where margin is highest: 100% Shopify.

Problem: Volume matters. If Shopify only sells 10/month but Amazon sells 50/month, you're leaving money on table.

Method 2: Total Profit Potential (Better)

Calculation:

- Shopify: 10 units/mo × $28.74 = $287.40/mo

- Amazon: 50 units/mo × $24.32 = $1,216.00/mo

- eBay: 5 units/mo × $22.40 = $112.00/mo

Allocation Decision:

- Stock out Amazon first (highest total profit)

- Restock Shopify when Amazon slows

- Use eBay for clearance only

Method 3: Days of Inventory Optimization (Best)

Factor in cash tied up:

- Shopify: 10/mo velocity = 10 days inventory cycle

- Amazon: 50/mo velocity = 0.6 days inventory cycle

- eBay: 5/mo velocity = 20 days inventory cycle

Cash flow impact:

- Amazon turns inventory 50× faster

- Less cash tied up in dead stock

- Higher annual return on inventory investment

Formula:

```

Annual ROI = (Profit per Unit × Units Sold per Year) / (COGS × Average Inventory)

Amazon: ($24.32 × 600) / ($12 × 12) = 101% annual ROI

Shopify: ($28.74 × 120) / ($12 × 30) = 96% annual ROI

eBay: ($22.40 × 60) / ($12 × 60) = 19% annual ROI

```

Amazon wins on cash efficiency even with lower per-unit margin.

When to EXIT a Channel (Red Flags)

Red Flag #1: Negative Profit After All Fees

If you're losing money per order, exit immediately.

Check Formula:

```excel

=IF(Revenue - COGS - AllFees < 0, "LOSING MONEY", "OK")

```

Common causes:

- Frequent returns eating profit (Amazon common issue)

- Storage fees accumulating (Amazon long-term storage)

- Price wars drove price below profitability

Red Flag #2: Margin Below 20% After Fees

You're not losing money but barely profitable. One mistake (return, damage) wipes out profit.

Threshold to exit: Net margin < 15-20% depending on volume.

Red Flag #3: High Volume, Low Total Profit

Example: Amazon does 1,000 orders/month at $2 profit each = $2,000 total.

Reality: Your time managing 1,000 Amazon orders might be worth more than $2,000.

Alternative: 100 Shopify orders at $30 profit = $3,000 total with less work.

Red Flag #4: Cash Flow Negative

Example: Amazon pays you 14 days after order. Your supplier needs paid upfront.

You're floating 14 days of COGS for all in-flight orders. If that exceeds your cash reserves, channel is killing your cash flow even if profitable on paper.

Strategic Channel Mix: The Portfolio Approach

Don't go all-in on one channel. Diversify like an investment portfolio.

The 70-20-10 Rule

70% of inventory → Your bread-and-butter channel

- Highest volume × good margin

- Proven track record

- For most sellers: Amazon or Shopify

20% of inventory → Your emerging channel

- Growing but not proven yet

- Testing new audience/market

- Could become future primary

10% of inventory → Experimental/clearance

- New channel testing

- Clearance sales

- Seasonal promotions

Risk Management Benefits:

1. Platform Risk: If Amazon suspends account, you have Shopify revenue

2. Market Risk: If Amazon saturates, Shopify traffic intact

3. Learning: Test products on low-fee Shopify before scaling on Amazon

Rebalancing Quarterly:

Every 90 days, recalculate:

- Which channel has highest profit per unit?

- Which has highest total profit?

- Which has best cash flow (days inventory × margin)?

Shift 70-20-10 allocation based on performance.

Skip the manual fee calculations. Get automated multi-channel profitability reports that compare Shopify, Amazon, eBay, and more - all fees calculated, margins compared, insights delivered.

Get Multi-Channel ReportsWorks with any sales channel combination

Common Mistakes to Avoid

Learn from these common pitfalls to ensure success

Comparing gross revenue instead of net profit by channel

Solution: Always calculate: Revenue - COGS - ALL fees (platform, payment, fulfillment, storage). Only net profit matters.

Forgetting Amazon storage fees in margin calculation

Solution: Amazon charges monthly storage. Allocate ~$0.50-2.00 per unit depending on cubic feet and season. Add to cost structure.

Not factoring return rates into channel profitability

Solution: Amazon averages 10-15% returns. Add (Return Rate × FBA Fee) to your true cost. $5 FBA fee × 10% = $0.50 hidden cost per order.

Allocating inventory based on revenue instead of profit

Solution: High-revenue channel might have low profit. Allocate based on: Units Sold × Profit per Unit × Inventory Turn Rate.

How to Verify Your Numbers

Ensure accuracy with these verification steps

Your total fees by channel match: Shopify ~3-4%, Amazon ~20-30%, eBay ~16%

Revenue - COGS - All Fees = Net Profit (positive for all SKUs, or you're losing money)

Your pivot table shows each channel's contribution to total profit (not just revenue)

When you sort by net margin %, Shopify/WooCommerce appear at top, Amazon middle, eBay bottom

Your dashboard clearly shows which channel drives the most profit dollars (might differ from highest margin %)

Frequently Asked Questions

Should I sell everywhere or focus on one channel?

Amazon has highest revenue but lowest margin. Is it worth it?

How often should I recalculate channel profitability?

What if a channel is profitable but kills my cash flow?

Should I raise prices on low-margin channels or exit?

Ready to Transform Your Reporting?

Start with a free report and see exactly what you'll get every time.